The JobKeeper payment is a subsidy of $1,500 per fortnight per eligible employee paid in arrears to the employer by the ATO. It’s for businesses that have suffered a detrimental decline in business because of COVID 19 to help keep their staff employed.

To receive the JobKeeper payment, there are a series of eligibility criteria and reporting and notification obligations that need to be met. It’s important to talk to your accountant and adviser to make sure you get it right.

Here’s a summary of what you need to do to claim JobKeeper payments for April. If these conditions are not met, you might still qualify for JobKeeper payments later in the year.

1. Is my business eligible?

On 1 March 2020:

- Carried on a business in Australia, or

- A non‑profit body pursuing its objectives principally in Australia

And, the business:

- Has not started liquidation or bankruptcy procedures

- Was not a government body of any kind (including wholly owned entities)

- Was not subject to the Major Bank levy (or part of a group where one of the members is subject to it)

If you are a sole trader, see Special Conditions for Business Owners.

2. Does the business meet the basic decline in turnover test?

Compare your GST Turnover for:

- March 2020

- The projected turnover for April 2020, or

- The projected turnover for the April – June 2020 quarter

with your actual GST turnover for the same period in 2019.

GST turnover includes taxable and GST-free sales, but not input taxed supplies like interest, dividends and residential rental income.

If you are not registered for GST you can still potentially qualify and will need to calculate the decline in turnover in much the same way as a GST registered business.

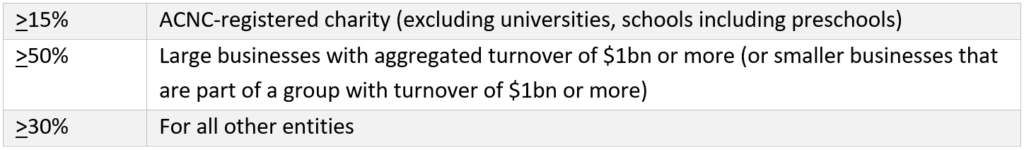

To qualify for JobKeeper, your decline in turnover needs to be:

If you can’t meet the decline in turnover test, there is an alternative test. Speak to your accountant.

3. Are my employees eligible?

An employee is eligible if on 1 March 2020, they were:

- Aged 16 years and over; and

- A full time, part time or a long-term casual*; and

- An Australian resident, or a resident for tax purposes and held a Subclass 444 (Special category) visa; and

- Not receiving paid Government parental leave or dad and partner pay, or full-time workers compensation.

If you are a sole trader, director or shareholder, partner in a partnership, or beneficiary of a trust, see Special Conditions for Business Owners.

4. JobKeeper nomination form to employees

If you have eligible employees you intend to claim JobKeeper payments for, they need to sign the JobKeeper Employee Nomination form and give it back to you by 30 April 2020.

An individual can only have one JobKeeper employer. The form ensures they are your JobKeeper and not someone else’s.

5. Register with the ATO

If the first eligibility tests are met, register for JobKeeper with the ATO. Your accountant can do this for you or use the ATO’s business portal (you will need a myGovID linked to your ABN).

6. Pay your employees by 30 April 2020

For April JobKeeper payments, you need to have paid your employees at least $1,500 per person (before tax or salary sacrifice) for the fortnights 30 March 2020 – 12 April 2020, and 13 April 2020 – 26 April 2020, by 30 April 2020.

Ensure each eligible employee is updated in your single touch payroll system by 30 April 2020. Talk to your accountant about how PAYG withholding and superannuation guarantee applies to employee payments.

7. Claim the JobKeeper amount

From 4 May 2020, identify your eligible employees (either through single touch payroll or through the business portal) and complete the declaration.

You will also need to provide your current and projected GST turnover (April 2020 and May 2020 for the first month).

Special Conditions for Business Owners:

One business owner – sole trader, director or shareholder, partner in a partnership, or an adult beneficiary of a trust – can qualify for JobKeeper payments, if the following conditions are met:

On 1 March 2020 the entity carried on a business that was not a not-for-profit; and

On 12 March had an ABN: and

- had some business income in the 2018-19 income year included in a tax return that was lodged by 12 March 2020; or

- made some supplies connected with Australia in a tax period that started on or after 1 July 2018 and ended before 12 March 2020 and recorded this on an activity statement lodged with the ATO by 12 March 2020.

- Passed the decline in turnover test (see 02).

And, on 1 March 2020 the individual:

- Was aged 16 years or over; and

- Actively engaged in the business; and

- Met the residency requirements (same as for employees at 03); and

- Was not employed in the business, or an employee of any other business (except as a casual), or a nominated JobKeeper of another business, or receiving parental leave payments or dad and partner pay, or receiving full -time workers compensation.

*A ‘long term casual employee’ is a person who has been employed by the business on a regular and systematic basis during the period of 12 months that ended on 1 March 2020 (1 March 2019 to 1 March 2020) and have a reasonable expectation of ongoing work.

Important: The material and contents provided in this publication are informative in nature only. It is not intended to be advice and you should not act specifically on the basis of this information alone. If expert assistance is required, professional advice should be obtained.