The 2022-23 Federal Budget was announced by Federal Treasurer, Mr Josh Frydenberg, on 29th March 2022.

Key Announcements:

- A $78 billion underlying cash deficit forecast for 2022-23, $20.9 billion better than forecast in the December 2021 Mid-Year Economic Fiscal Outlook

- A package to address cost of living pressures includes a temporary fuel excise cut, one off payments of $250 to eligible recipients and an increase of $420 to the Low-to-Middle-Income Tax Offset

- 120% tax deduction for small businesses to upskill employees and encourage digital adoption

- Expansion of the Patent box regime to the low emissions technology and agricultural sectors

- Extra funding announced for COVID-19 ($6 billion), mental health (further $547 million over 5 years), aged care (further $468.3 million over 5 years) and $39.6 billion to continue the NDIS program

- Responses to climate and natural disaster impacts, alongside continued focus on low emissions technology and energy security

- Significant funding allocated to build resilience into Australia’s infrastructure networks

- Significant investment in readiness of the workforce for the digital economy

- Parents in charge; more flexibility in Paid Parental Leave.

Personal & Individuals

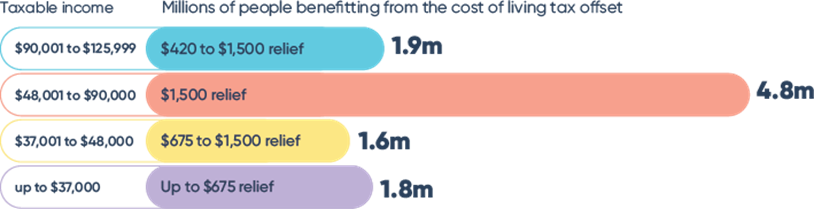

From 1 July this year, over 10 million individuals will receive a one-off $420 cost of living tax offset. Combined with the low and middle-income tax offset (LMITO), eligible low and middle-income earners will receive up to $1,500 for a single income household, or up to $3,000 for a dual income household.

Tax relief from the cost-of-living tax and LMITO

- The LMITO will be increased by $420 in the 2021–22 income year to ease the current cost of living pressures.

- A one-off payment of $250 will be made to individuals who are currently in receipt of Australian government social security payments, including pensions. Payment is expected in April 2022.

- Additional funding will be provided over 5 years to support older Australians in the aged care sector to assist with managing the impacts of the COVID-19 pandemic.

- Costs of taking a COVID-19 test to attend a place of work will be tax deductible for individuals and exempt from fringe benefits tax from 1 July 2021.

- A single Paid Parental Leave scheme of up to 20 weeks paid leave will replace the existing system of 2 separate payments.

- CPI indexed Medicare levy low-income threshold amounts for singles, families, and seniors and pensioners for the 2021–22 year announced.

- The number of guarantees under the Home Guarantee Scheme will be increased to 50,000 per year to assist home buyers who have a lower deposit.

Business and Tax Administration

- Additional state and territory COVID-19 business support grant programs will be eligible for tax treatment as non-assessable non-exempt income until 30 June 2022.

- Small and medium businesses will be able to deduct an additional 20% of expenditure incurred on external training courses provided to their employees.

- Small and medium businesses will be able to deduct an additional 20% of eligible expenditure supporting digital adoption.

- The Boosting Apprenticeship Commencements wage subsidy will be extended by 3 months.

- Concessional tax treatment will apply from 1 July 2022 for primary producers selling Australian Carbon Credit Units and biodiversity certificates.

- Access to employee share schemes in unlisted companies will be expanded.

- The PAYG instalment system is set for a structural overhaul with a set GDP uplift of 2% to apply for the 2022–23 income year.

- Additional funding will be provided to further reform insolvency arrangements, including the insolvent trading “safe harbour”.

- Business registry fees will be streamlined over 3 years from 2023–24.

- Wholly owned Australian incorporated subsidiaries of the Future Fund Board of Guardians will be exempt from corporate income tax.

Excise and customs duty

Cost of living relief at the petrol pump: Temporary fuel excise relief

The Russian invasion of Ukraine has seen fuel prices increase, adding to cost of living pressures faced by families and the cost of doing business for small businesses. The Government is taking decisive, responsible and temporary action to cut fuel excise and reduce the pressure of high fuel prices on household budgets.

As part of Australia’s plan for a stronger future, the Government will reduce fuel excise by 50% for 6 months. This will see excise on petrol and diesel cut from 44.2 cents per litre to 22.1 cents per litre. Fuel subject to a lower excise rate is expected to flow through to the majority of service stations and Australian consumers within a few weeks as stations replenish their stocks.

Superannuation

- The 50% reduction of the superannuation minimum drawdown requirements for account-based pensions will be extended for an additional year.

- There were no changes to the legislated rates of superannuation guarantee. The rates as legislated are as follows:

- 1 July 2021 – 30 June 2022 10.0%

- 1 July 2022 – 30 June 2023 10.5%

- 1 July 2023 – 30 June 2024 11.0%

- 1 July 2024 – 30 June 2025 11.5%

- 1 July 2025 – 30 June 2026 and onwards 12%.

Innovation Incentives

- Corporate income from the commercialisation of patents, issued from 29 March 2022, in respect to agricultural and veterinary (agvet) chemical products will be taxed at an effective rate of 17% for income years starting from 1 July 2023.

- The effective tax rate of 17% for the “patent box” regime will also be expanded to include patents that have the potential to lower emissions.

- Following on from the 2021 Federal Budget announcement of the “patent box” regime for medical and biotechnology innovations, the concessional tax treatment will be expanded to include certain overseas jurisdictions with equivalent patent regimes.

Business Tax administration

- Companies will be able to choose to have their PAYG instalments calculated based on current financial performance, extracted from business accounting software, with some tax adjustments.

- Businesses will be allowed the option to report taxable payments reporting system data (via accounting software) on the same lodgement cycle as their activity statements.

- Trust and beneficiary income reporting and processing will be digitalised.

- IT infrastructure will be developed to allow the ATO to share single touch payroll data with state and territory revenue offices.

- The ATO will be given funding to extend the operation of the Tax Avoidance Taskforce by 2 years.

- The start date of the 2019–20 Budget measure for holders of Australian Business Numbers will be deferred by 12 months.

Small business measures

Skills and training boost

Small businesses (with aggregated annual turnover of less than $50 million) will be able to deduct an additional 20% of expenditure incurred on external training courses provided to their employees. The external training courses will need to be provided to employees in Australia or online and be delivered by entities registered in Australia.

The boost will apply to eligible expenditure incurred from 7.30 pm on 29 March 2022 (Budget night) until 30 June 2024. Eligible expenditure incurred by 30 June 2022 will be claimed in tax returns for the following income year. The boost for eligible expenditure incurred between 1 July 2022 and 30 June 2024, will be included in the income year in which the expenditure is incurred.

Not-for-profits

- Melbourne Business School Ltd, Advance Global Australians Ltd, Leaders Institute South Australia Inc, St Patrick’s Cathedral Melbourne Restoration Fund, and various entities related to Community.

- Foundations Australia have been added to the list of specifically DGRs for a period beginning 1 July 2022.

Indirect tax

- The Indirect Tax Concession Scheme (ITCS) has been granted or extended to various diplomatic and consular representations.

More affordable childcare

Ensuring access to childcare for all families by reducing out-of-pocket expenses

The Government’s support for childcare is easing cost‑of‑living pressures for families and supporting choices for working parents.

The Government has invested $62 billion since 2013, with a record $10.3 billion forecast to be spent in 2021‑22. This investment is in addition to the $1.7 billion provided in last year’s Budget to make childcare more affordable for families through the removal of the annual cap on the Child Care Subsidy and increased subsidies for second and subsequent children. This is improving cost of living pressures for around 250,000 families, saving them on average, around $2,260 per year, depending on their household income and the number of children in childcare.

The Government continues to support childcare services facing challenging circumstances, including COVID-19 and recent floods. This includes $279 million in COVID‑19 support, $6.9 million in business continuity payments and support for services through Special Circumstances grants in the Community Child Care Fund.

Putting home ownership in reach for more Australians

The Government is backing aspiring homeowners to achieve their dreams sooner

Home ownership is vital to the social and economic wellbeing of Australians. The Government is supporting more Australians into the housing market.

More help to achieve home ownership sooner

Under the Home Guarantee Scheme, part of an eligible home buyer’s home loan will be guaranteed, enabling Australians to enter the property market sooner with a smaller deposit.

Building on its success to date, the Government is expanding the Home Guarantee Scheme to make available 50,000 places per year, more than double the current number of places available. A new Regional Home Guarantee will be established while the number of places under the Family Home Guarantee supporting single parents will double.

This will enable more Australians to achieve their aspirations of home ownership.

Savings fast track for first home buyers

The First Home Super Saver Scheme (FHSSS) helps Australians boost their savings for a first home by allowing them to build a deposit inside superannuation, giving them a tax cut. For most people, the FHSSS can boost the savings they can put towards a deposit by at least 30 per cent compared with saving through a standard deposit account.

From 1 July 2022, the maximum amount of voluntary contributions that can be released under the FHSSS will be increased from $30,000 to $50,000 enabling first homeowners to achieve their dreams of home ownership sooner.

If you require further clarification on any of the information announced in the 2022-23 federal budget, please don’t hesitate to get in touch on (03) 9810 3666.

Kind Regards,

The HTA Team